by Mark Spurlin, CPA

Visit Complexity Add-On HCPCS code G2211 is a new add-on code for office outpatient evaluation and management (Codes 99202-99205, 99211-99215) that can be used when physicians provide a broader set of service to address a patient’s healthcare needs with continuity over a longer period of time. This code has been under consideration for years now, but Medicare just began processing payments for it this week.

This newly implemented code offers additional reimbursement that may seem insignificant on its own, but the coding change has the potential to make a significant impact on the bottom line for some practices, especially primary care specialties with providers on production-based compensation models.

Here are Five things you need to know:

- According to the CMS Claims Processing Manual, “HCPCS code G2211 includes services that enable practitioners to build longitudinal relationships with all patients (that is, not only those patients who have a chronic condition or single, high-risk disease) and to address the majority of patients’ health care needs with consistency and continuity over longer periods of time. This includes furnishing services to patients on an ongoing basis that result in care that is personalized to the patient. The services result in a comprehensive, longitudinal, and continuous relationship with the patient and involve delivery of team-based care that is accessible, coordinated with other practitioners and providers, and integrated with the broader health care landscape.”1

- Not payable when reported with payment Modifier 25, used when a separately identifiable E&M services is provided on the same day as another procedure or service by the same provider.

- This code is not restricted to medical professionals based on specialties. That said, CMS estimates utilization to be as high as 90 percent of office outpatient E&M visits for many primary care providers, and with 38 percent of all office outpatient E&M visits in 2024.

- Under proposed utilization assumption for CY 2024, CMS estimates the effect of implementing G2211 to account for a 2.0 percent decrease, of the total 2.2 percent decrease in the 2024 CF Budget Neutrality Adjustment (i.e. 90 percent). Therefore, causing a disproportionate negative impact on many surgical specialties and specialties like radiology and others that are expected to be low utilizers of the add-on code.

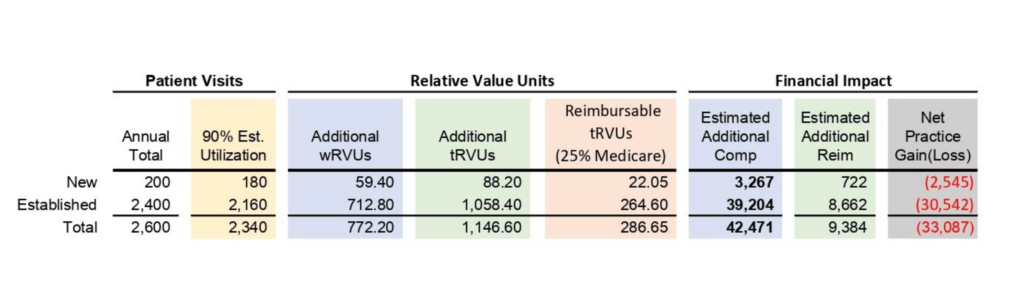

- G2211 has .33 Work RVUs and .49 Total RVUs, representing additional reimbursement of approximately $16 from each claim approved by Medicare [.49 tRVUs x $32.74 (CY 2024 CMS National CF)]. This can have significant implications for practices and providers based on payor mix and utilization, especially in cases where provider compensation is paid based on wRVUs. The following illustrates the financial impact of a primary care provider on a production-based compensation model earning $55 per wRVU, utilizing the G2211 code on 90 percent of the office outpatient E&M visits, with Medicare representing 25 percent of their payor mix:

In this example, a primary care provider seeing 2,600 patients annually, utilizes the G2211 add-on code on 90 percent of their visits would generate an additional 772 Work RVUs, which would equate to an additional $42,471 in compensation (assuming a straight productivity model paid at $55 per wRVU). However, assuming Medicare makes up 25 payor of the payor mix and assuming they’re the only payor reimbursing for the code, the practice would only receive about $9,400 in additional revenue, resulting in a net loss of approximately $33,000 per provider.

The implications of the implementation of G2211 will be unique for each provider and practice and much harder to project. Unlike the wRVU changes applied to the office outpatient E&M codes introduced in 2021 where you could take prior production and apply the new wRVU values to get a pretty good indication of production and reimbursement, the G2211 is a completely new add-on code with varying and unknown utilization rates, which as illustrated can have significant financial implications for both the practice and providers.

At Root Valuation, we strive to stay on top of the constantly evolving landscape in order to help our clients successfully plan and navigate fair market value implications from changes such as these. If you have any questions regarding how the implementation of the G2211 add-on code may affect the value of your organization, please contact Mark Spurlin at 720.458.3766 or mspurlin@rootvaluation.com

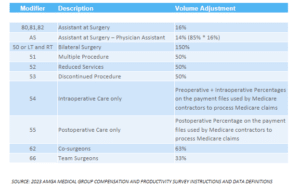

Modifiers play a significant role in affecting Relative Value Units (RVUs) in physician valuation. These modifiers indicate specific circumstances that alter a service or procedure without changing its definition or code. They are used to provide additional information or modify the description of the service to enhance accuracy and specificity. Modifiers can be alphabetic, numeric, or a combination of both, and they are always represented by two digits.

Modifiers play a significant role in affecting Relative Value Units (RVUs) in physician valuation. These modifiers indicate specific circumstances that alter a service or procedure without changing its definition or code. They are used to provide additional information or modify the description of the service to enhance accuracy and specificity. Modifiers can be alphabetic, numeric, or a combination of both, and they are always represented by two digits.