by Mark Spurlin, CPA

In the realm of physician practice valuation, Relative Value Units (RVUs) play a crucial role in determining the worth of medical services provided by physicians. RVUs are a standardized method used to measure the relative value and complexity of medical procedures and services. Implemented in coordination with the American Medical Association (AMA), the AMA Specialty Society Relative Value Scale Update Committee (RUC) is responsible for establishing and updating RVUs. Let’s explore the three main components of RVUs, namely Physician work (Work RVUs), Practice expense (PE RVUs), and Malpractice expense (MP RVUs), and their significance in physician practice valuation.

Physician work (Work RVUs):

Work RVUs account for the level of effort, skill, and time required by a physician to perform a specific procedure or service. Numerous variables contribute to the determination of Work RVUs, including technical skills, physical effort, mental effort and judgement, stress related to patient risk, and the duration of the service or procedure. For instance, a complex surgery that demands extensive training, critical decision-making, and lengthy operating time would be assigned higher Work RVUs compared to a routine office visit. Work RVUs recognize the professional expertise and effort invested by physicians in delivering patient care.

Practice expense (PE RVUs):

PE RVUs reflect the cost incurred by a physician’s practice in providing medical services. These expenses encompass both clinical and nonclinical labor and various overhead costs. Medical supplies, office supplies, clinical and administrative staff salaries, building space, utilities, medical equipment, and office equipment are all factors considered in calculating PE RVUs. The allocation of expenses to each medical service is done based on a pro-rata basis, taking into account the relative cost associated with delivering that particular service. By including practice expenses, RVUs provide a comprehensive assessment of the economic resources required to sustain a physician’s practice.

Malpractice expense (MP RVUs):

MP RVUs account for the cost of professional liability insurance associated with each Current Procedural Terminology (CPT) code. The relative risk associated with different procedures is estimated, and the corresponding malpractice expense is factored into the RVU calculation. Medical specialties with higher malpractice risks, such as neurosurgery or obstetrics, typically have higher MP RVUs compared to specialties with lower inherent risks. By incorporating malpractice expenses, RVUs address the financial impact of potential professional liabilities, thereby aiding in fair and accurate physician practice valuation.

Modifiers for RVU’s

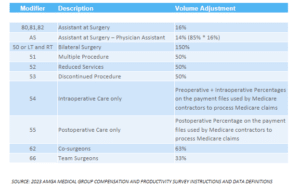

Modifiers play a significant role in affecting Relative Value Units (RVUs) in physician valuation. These modifiers indicate specific circumstances that alter a service or procedure without changing its definition or code. They are used to provide additional information or modify the description of the service to enhance accuracy and specificity. Modifiers can be alphabetic, numeric, or a combination of both, and they are always represented by two digits.

Modifiers play a significant role in affecting Relative Value Units (RVUs) in physician valuation. These modifiers indicate specific circumstances that alter a service or procedure without changing its definition or code. They are used to provide additional information or modify the description of the service to enhance accuracy and specificity. Modifiers can be alphabetic, numeric, or a combination of both, and they are always represented by two digits.

In the National Physician Fee Schedule Relative Value File, there are two modifiers included: TC (Technical Component) and 26 (Professional Component). The TC modifier is used when a physician performs a test but does not interpret the results, while the 26 modifier is used when a physician interprets the test results but does not perform the test.

Modifiers allow for greater flexibility and accuracy in capturing the distinct components of a medical service or procedure. They help differentiate between the work performed by the physician and other involved parties, such as technicians or specialists. By utilizing modifiers appropriately, RVUs can be adjusted accordingly to reflect the specific circumstances and contributions of the healthcare professionals involved in delivering the care. These modifiers ensure that the RVUs accurately capture the professional and technical components of medical services, allowing for fair compensation and precise evaluation of physician work.

Importance in Physician Practice Valuation

RVUs serve as a fundamental component of physician practice valuation, as they provide a standardized and objective framework for assessing the value of medical services. By considering the three main components—Work RVUs, PE RVUs, and MP RVUs—RVUs offer a comprehensive evaluation of the resources and costs associated with delivering healthcare. These valuation metrics are essential for various purposes, including reimbursement rates, negotiating managed care contracts, assessing productivity, and determining fair compensation for physicians.

The RUC, in collaboration with the AMA, periodically updates the RVUs to ensure they reflect changes in costs, technology, and medical practice. This five-year update cycle allows for adjustments in response to advancements in medical technology, changes in healthcare delivery, and shifts in the relative value of medical services.

Relative Value Units (RVUs) are a vital component in physician practice valuation, enabling a standardized approach to determine the worth of medical services provided by physicians. These metrics play a crucial role in various aspects of the healthcare industry, such as reimbursement, contract negotiations, productivity assessments, and so much more. At Root Valuation, we help physician leaders successfully navigate business and employment transactions to that their value is fully realized. If you have any questions about RVU’s, speak with Mark Spurlin at 720.458.3766 or contact us at info@rootvaluation.com.